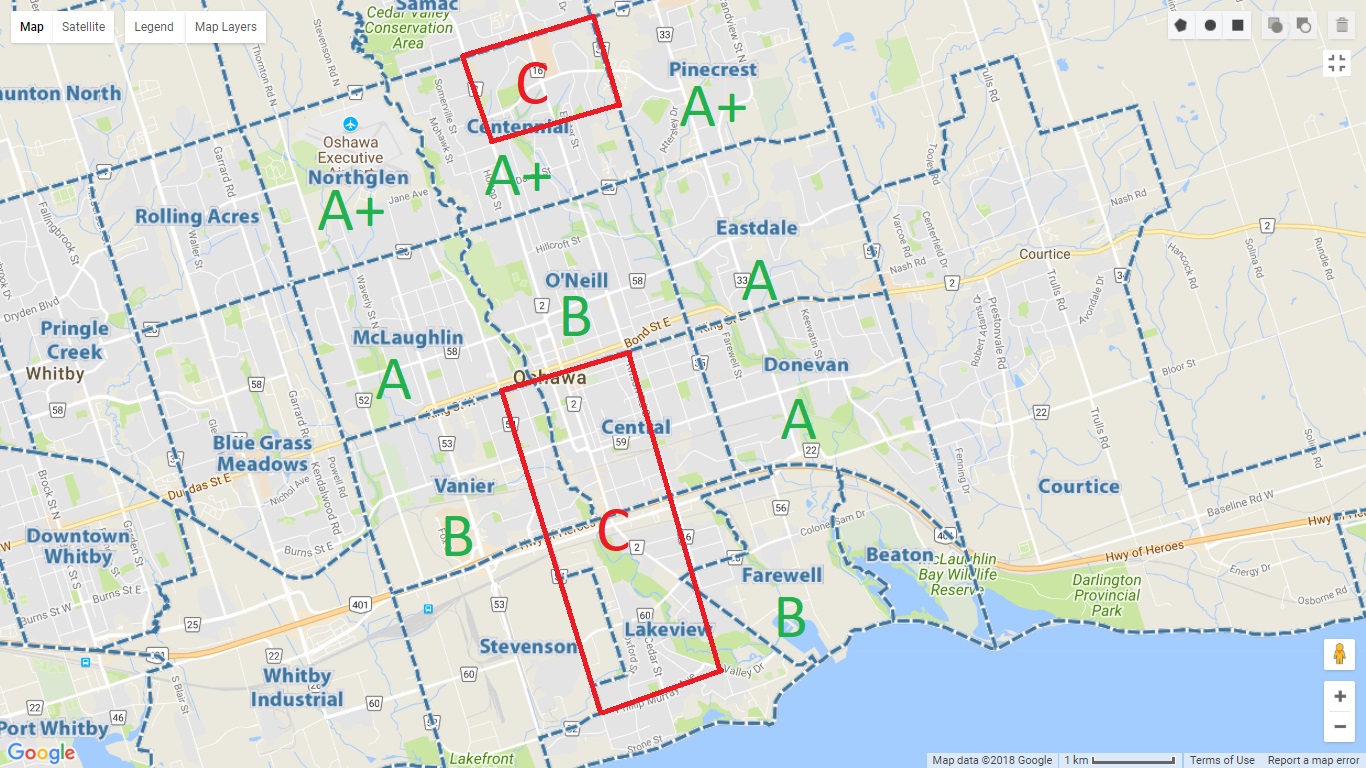

Here is a copy of the city of Oshawa’s 2022 Economic outlook

Tag: legal 2-unit

November 2022 Market thoughts

First, I will say I understand we have a supply issue, I understand immigration targets for Canada but….in my humble opinion

Nothing can fight the RE math. Do you know what is stronger than demand? Affordability! Current prices don’t work with today’s mortgage rates. Period. This is also why we have seen prices drop 20-30% off February highs when supply has not changed! Its just simply demand destruction.

In the residential market I think people are either:

A) In a adjustable rate mortgage and already feeling the pain of increased payments, cost of living going up. They are stuck trying to navigate this and in a lot of cases hanging on for dear life.

B) People in a variable rate mortgages, the bank of Canada has said 50% of people have reached their trigger rates or are paying 100% of their payment in interest, I have also heard banks are now allowing unpaid interest to be added to the principle amount….boy thats a slippery slope

C) In a fixed rate and going to feel the pain on renewal in the next 2-3 years when their payments jump 200-300%. Will banks allow for longer amortizations on renewals? Could be

In the commercial market, sellers and buyers have a large disconnect. Sellers want 4 cap prices in a 6% interest rate environment, again the math just doesn’t work

That doesn’t mean real estate transactions wont happen, people will still need to sell, still need to buy but the truth is, sales are already down 49% y/y from October 2021 to October 2022. So buyers being strapped or sellers having no where to go because of supply issues is real. I expect more of the same in 2023

Legal 2-unit Process in Oshawa

Here is a PDF that the City of Oshawa published talking about everything you need to know for registering a Legal 2-unit dwelling in Oshawa.

Why Invest in Oshawa?

When looking at where to invest in real estate the first thing you must do is compare the income to expenses. When I purchase an investment property, will it generate cashflow each month with all expenses considered? Oshawa is the last City in the Greater Toronto Area where you can generate cashflow on an investment property, a trend that I think will only last so long. House prices in Whitby, Ajax, Pickering, Scarborough, and Toronto and surrounding area do not generate cashflow, period. Now there are lots of other Cites in Ontario that generate cashflow, but none that have the ‘protection’ of Toronto. Even though Oshawa has some major employers such as General Motors, Ministry of Finance, University of Ontario, Durham College, Lakeridge Health, and Ontario Power Generation we still have 30% of our workforce commuting to Toronto. Why is that so important to me? We are in the rental business, and as long as there is work, there are people that need to rent!

- Population Growth: Double per capita than the USA, over 100K people coming in each year. The vacancy rate across the Golden horseshoe is in the low single digits.

- Land Scarcity: Lake Ontario on one side, the largest Green Belt in the world on the other, as population increases, land is becoming scarce.

- Lack of Supply: Simply put, not enough homes are being built to satisfy the supply for years to come.

- Canadian Desirability: Toronto voted #1 in 2017 for quality of life and also a key area for foreigners to invest their dollars into.

- Transportation Funding: 407 Extension to 115, Durham region will both get 4 new GO stations by 2023, this in preparation for the population growth over the next several decades.

While there is a lot that can be looked at when it comes to economic drivers and market factors, looking for areas where the city planners are investing in transportation, and where big development is starting to follow is a consistent, predictable way to find the best natural appreciation and where growth is most likely to occur.

Why the Legal 3+2 Unit Property?

In my opinion the 3+2 bedroom legal two unit dwelling is the perfect combination between solid numbers, ease of entry, and ease of management

The reason why condos and single family residential are such a popular investment are because of how easy they to get into and while that is true the major problem is the properties are not turning a profit, yes losing money each month. Investors are gambling that the market will go up and that’s how they will offset the negative cashflow.

On the other end of the spectrum you have multi-family properties which are 3 or more units, which can generate great cashflow with a great return on investment. They have a higher barrier for entry though because they are typically more expensive and will likely need more money down if you need a commercial mortgage. Also with a multi-unit investment, the tenant profile can be lower as well, making it harder to manage

The 1960’s brick bungalow is the perfect investment option because they are typically in quiet residential streets with large lots, separate entrances, and liveable basements that allow for a legal second suite.

The 60’s bungalow also has a low barrier for entry and a high quality tenant profile, but unlike a condo can give you high ROI. The reason you can get such a higher ROI is because you have the ability to add value quickly with the Buy Fix Refi Rent investment strategy.