First, I will say I understand we have a supply issue, I understand immigration targets for Canada but….in my humble opinion

Nothing can fight the RE math. Do you know what is stronger than demand? Affordability! Current prices don’t work with today’s mortgage rates. Period. This is also why we have seen prices drop 20-30% off February highs when supply has not changed! Its just simply demand destruction.

In the residential market I think people are either:

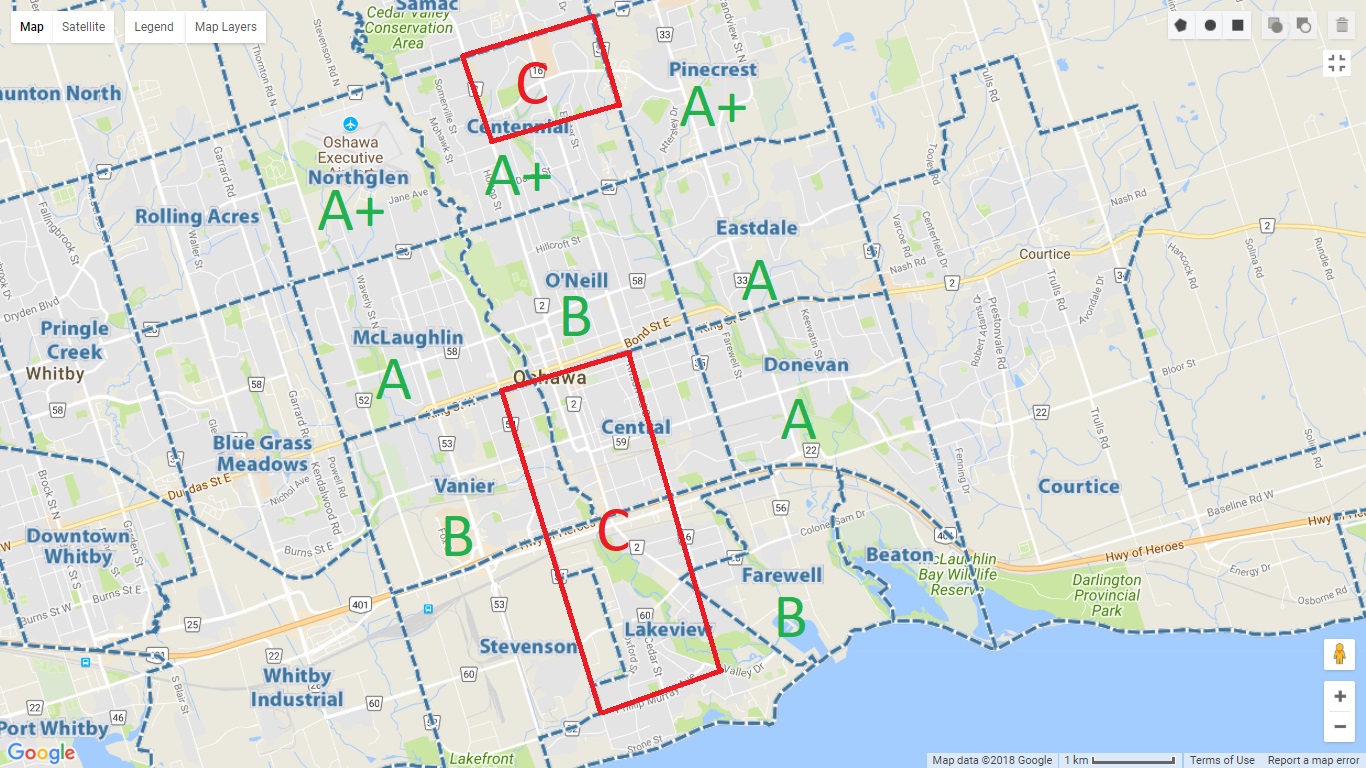

A) In a adjustable rate mortgage and already feeling the pain of increased payments, cost of living going up. They are stuck trying to navigate this and in a lot of cases hanging on for dear life.

B) People in a variable rate mortgages, the bank of Canada has said 50% of people have reached their trigger rates or are paying 100% of their payment in interest, I have also heard banks are now allowing unpaid interest to be added to the principle amount….boy thats a slippery slope

C) In a fixed rate and going to feel the pain on renewal in the next 2-3 years when their payments jump 200-300%. Will banks allow for longer amortizations on renewals? Could be

In the commercial market, sellers and buyers have a large disconnect. Sellers want 4 cap prices in a 6% interest rate environment, again the math just doesn’t work

That doesn’t mean real estate transactions wont happen, people will still need to sell, still need to buy but the truth is, sales are already down 49% y/y from October 2021 to October 2022. So buyers being strapped or sellers having no where to go because of supply issues is real. I expect more of the same in 2023