Author: camcassidy

Thursday. September 18th Investor Email

|

Why Invest in Oshawa?

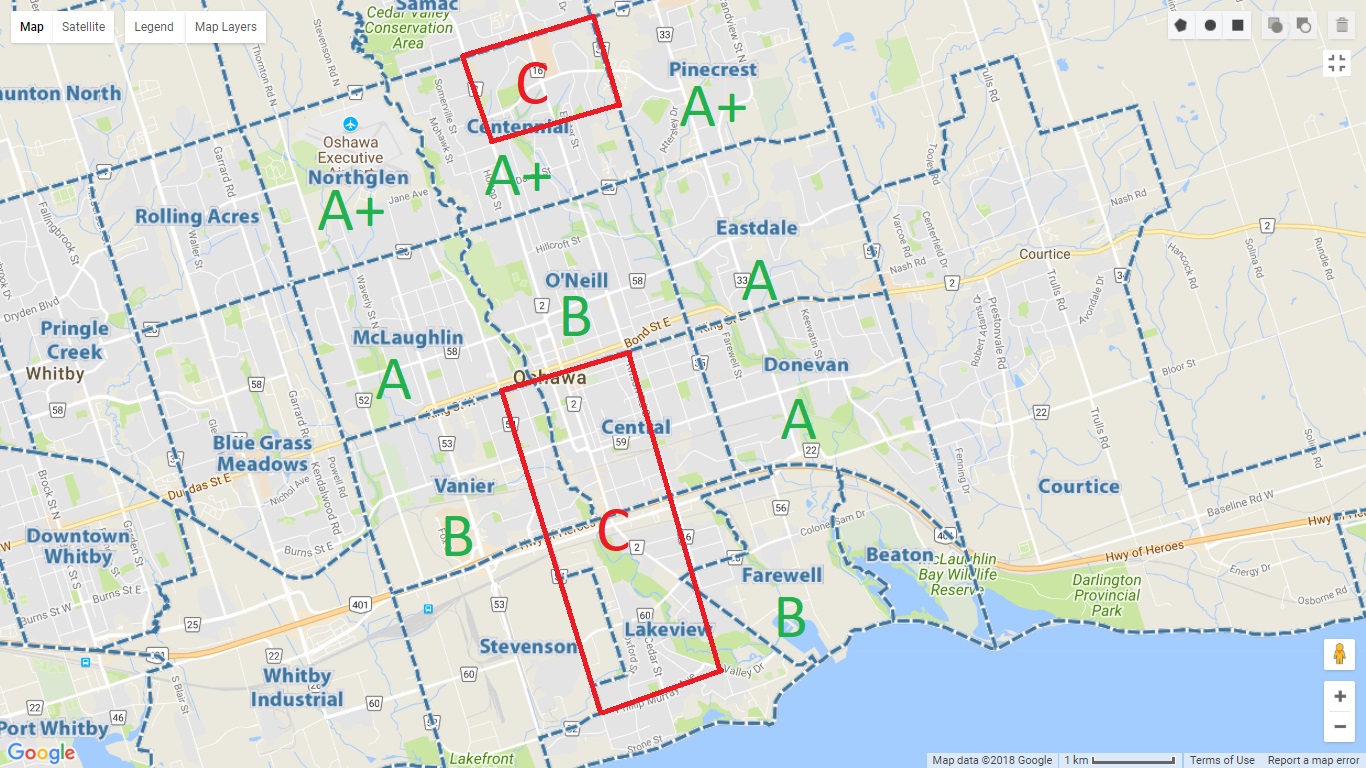

When looking at where to invest in real estate the first thing you must do is compare the income to expenses. When I purchase an investment property, will it generate cashflow each month with all expenses considered? Oshawa is the last City in the Greater Toronto Area where you can generate cashflow on an investment property, a trend that I think will only last so long. House prices in Whitby, Ajax, Pickering, Scarborough, and Toronto and surrounding area do not generate cashflow, period. Now there are lots of other Cites in Ontario that generate cashflow, but none that have the ‘protection’ of Toronto. Even though Oshawa has some major employers such as General Motors, Ministry of Finance, University of Ontario, Durham College, Lakeridge Health, and Ontario Power Generation we still have 30% of our workforce commuting to Toronto. Why is that so important to me? We are in the rental business, and as long as there is work, there are people that need to rent!

- Population Growth: Double per capita than the USA, over 100K people coming in each year. The vacancy rate across the Golden horseshoe is in the low single digits.

- Land Scarcity: Lake Ontario on one side, the largest Green Belt in the world on the other, as population increases, land is becoming scarce.

- Lack of Supply: Simply put, not enough homes are being built to satisfy the supply for years to come.

- Canadian Desirability: Toronto voted #1 in 2017 for quality of life and also a key area for foreigners to invest their dollars into.

- Transportation Funding: 407 Extension to 115, Durham region will both get 4 new GO stations by 2023, this in preparation for the population growth over the next several decades.

While there is a lot that can be looked at when it comes to economic drivers and market factors, looking for areas where the city planners are investing in transportation, and where big development is starting to follow is a consistent, predictable way to find the best natural appreciation and where growth is most likely to occur.

Why the Legal 3+2 Unit Property?

In my opinion the 3+2 bedroom legal two unit dwelling is the perfect combination between solid numbers, ease of entry, and ease of management

The reason why condos and single family residential are such a popular investment are because of how easy they to get into and while that is true the major problem is the properties are not turning a profit, yes losing money each month. Investors are gambling that the market will go up and that’s how they will offset the negative cashflow.

On the other end of the spectrum you have multi-family properties which are 3 or more units, which can generate great cashflow with a great return on investment. They have a higher barrier for entry though because they are typically more expensive and will likely need more money down if you need a commercial mortgage. Also with a multi-unit investment, the tenant profile can be lower as well, making it harder to manage

The 1960’s brick bungalow is the perfect investment option because they are typically in quiet residential streets with large lots, separate entrances, and liveable basements that allow for a legal second suite.

The 60’s bungalow also has a low barrier for entry and a high quality tenant profile, but unlike a condo can give you high ROI. The reason you can get such a higher ROI is because you have the ability to add value quickly with the Buy Fix Refi Rent investment strategy.

How to start making money with Air B&B Arbitrage

I get a lot of people who come out to my workshops that would love to get into real estate but just do not have a lot of money saved up, or any equity they can pull out of a home they own.

Of course, Air B&Bing a unit that you own can be very lucrative but this is one way you can start a ‘side hustle’ that has a low barrier for entry and can give you extra cash to invest.

I introduce you to Air B&B arbitrage, you are signing a long term lease with a landlord then renting that unit on Air B&B or other short term booking platforms. The major benefit is that you don’t have the large upfront cost of purchasing an investment property which needs 20% downpayment. Short term rentals can get double the rent in a month of a long term rental! For example if your long term monthly rent is $3,000 dollars but your unit brings in $5,000 dollars, you have a profit of $2,000 dollars that month. Of course, when starting any business there are risks involved, here are a couple challenges you will face.

The first and most obvious risk is that if you don’t get the unit rented enough to cover your monthly rent, you will lose money on that given month. There are lots of websites that can help you determine areas that are in high demand for short term rentals such as https://www.airdna.co. Once you identify an area you will need to find a solid unit and negotiate a good price so that you are profitable. Offering the landlord a percentage of the profit can be a good way to get the unit at a good price to reduce your risk.

You may also have to convince landlords that this is a good option for them. Here are a couple points you can share with them:

- With an Air B&B you do not fall under the RTA (Residential Tenancy Act) which means that if a guest overstays their welcome, you can have the police remove them with one phone call.

- Typically any damage that happens would be to the furnishings which would be owned by you, not them. If there is any damage to the unit, your cleaners will report it and either take it from the damage deposit the guest has put down, or Air B&B has insurance that will cover you!

- What landlord doesn’t want their unit professionally cleaned 5-6 times a month? In order to get good reviews and lots of bookings, the rental unit has to be in tip top shape at all times. This includes the lawn, garden beds, and the removal of snow on driveways in the winter.

Success in any business typically comes down to management, answering booking questions and cleaning staff will be the biggest challenges. The good news is most people are sending a message with questions about the unit through the app, so if you are comfortable on your phone, this shouldn’t be anything more then extra screen time. It won’t be hard to find cleaning staff but hiring reliable, honest staff that continue to produce quality results will be tricky. I would suggest having backup options in place at all times to avoid having to go clean the unit yourself.

Lastly, you will need to furnish the unit which does have some up front cost. You will want to purchase good quality items that will last. Because you will be washing your bed sheets after each stay, they need to be something that can handle the repeated washing. Quality beds are the very important to guests, they want to know that that what they are sleeping in is clean, and comfortable. If your unit is not well furnished, you will get bad reviews which will eventually kill your business.

The beauty of this business is that it is scalable, with your cleaning staff in place, it’s up to you to find landlords, furnish the unit, then get it up and running. This investment strategy is designed for somebody who wants to work to make extra cash each month but doesn’t have the resources or credit yet to start buying.

I lot of cities are starting to ban or restrict these short term rentals because as you can image, the hotel industry is not happy with the competition. You just need to aware of the city by-laws and find one that has already said they will allow it.

Cameron Cassidy, Investor and Real Estate Broker

New Facebook post! Check it out

https://www.facebook.com/448495285334341/posts/995076627342868

New Facebook post! Check it out

https://www.facebook.com/448495285334341/posts/994646097385921

New Facebook post! Check it out

https://www.facebook.com/448495285334341/posts/993317724185425

New Facebook post! Check it out

https://www.facebook.com/448495285334341/posts/990431141140750

New Facebook post! Check it out

https://www.facebook.com/448495285334341/posts/989076597942871