As we move into the spring season, I’m excited to share the latest insights on the Durham Region real estate market. Here’s what’s happening as of March 28, 2025:

Key Market Highlights:

- Sales Activity: Early spring has brought a noticeable uptick in buyer interest. While sales in February 2025 were down 26% compared to the previous year, the pace has started to accelerate in March, signaling a busy season ahead.

- Average Sale Prices: The average home price in Durham Region remains competitive, hovering around $894,698 (based on March data reported so far), down slightly by 1.3% from February and 4.5% from last March. This stability continues to make Durham one of the most affordable regions in the Greater Toronto Area (GTA).

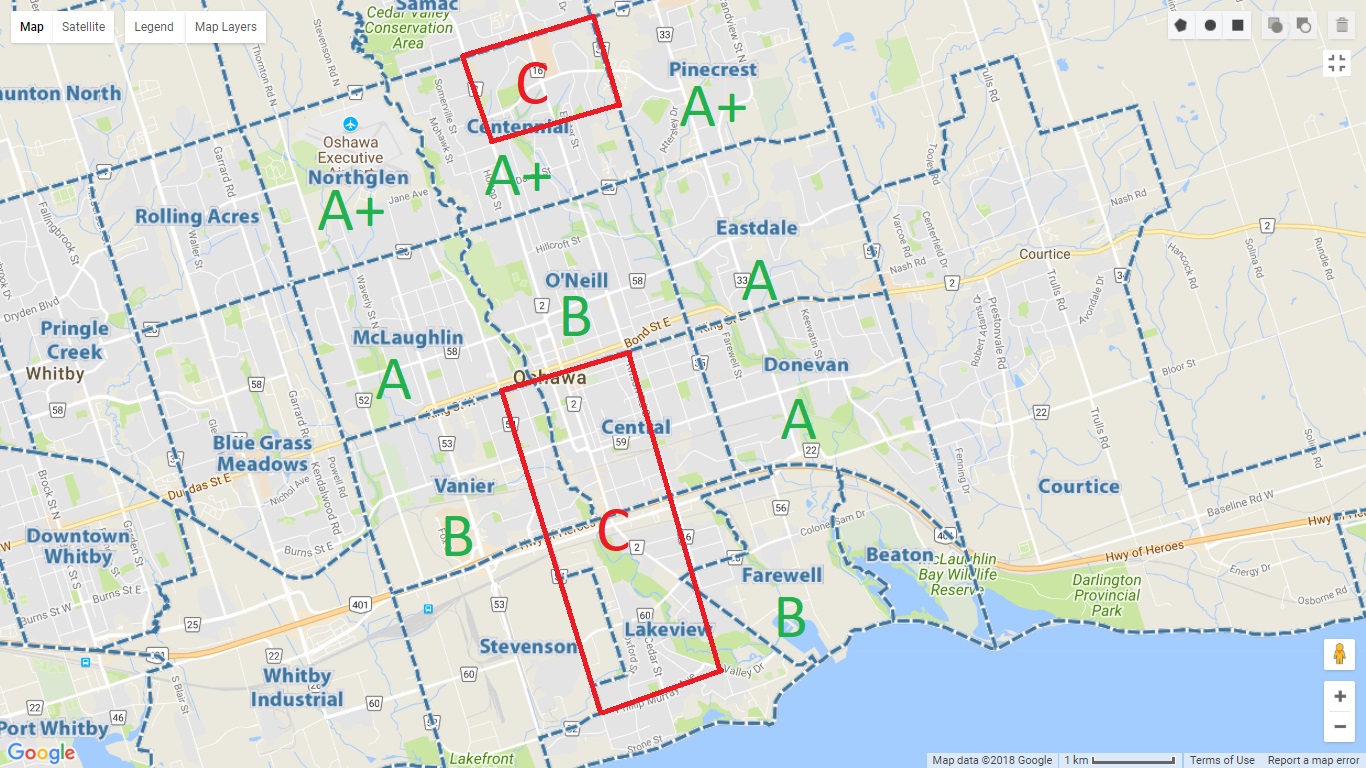

- Inventory Levels: Inventory is on the rise, with 3.4 months of inventory region-wide. This increase offers buyers more choice, though popular areas like Whitby and North Oshawa are still seeing quick sales due to high demand and limited supply.

- Buyer Competitiveness: Durham leads the GTA with a sale-to-list price ratio of 101.5%, reflecting strong buyer interest and competitive offers, especially for well-priced properties.

What’s Driving the Market?

- Lower Mortgage Rates: Recent drops in borrowing costs have energized the market, encouraging first-time buyers and move-up families to act.

- Seller’s Market Persists: Despite growing inventory, demand continues to outpace supply in key segments like detached homes and townhouses, keeping conditions favorable for sellers.

- Spring Momentum: With winter behind us, listing activity has surged, setting the stage for a fast-paced spring market.

Tips for Buyers and Sellers:

- For Buyers: Now’s the time to lock in a property before competition heats up further. Focus on homes priced realistically to avoid bidding wars.

- For Sellers: Pricing competitively remains key, especially in higher price brackets and condo markets, to attract serious offers quickly.

Whether you’re looking to buy, sell, or simply stay informed, I’m here to help you navigate this dynamic market. Let’s connect to discuss your goals and how we can make them a reality this spring!